Bullhorn at the Lemonade Stand and Klarna's Bad Debt Issue

I don’t think an 8-year-old boy should have a bullhorn.

My neighbors across the street disagree.

I’m working in the kitchen with my dog and hear streams of “LEMONADE STAND!” through a bullhorn. This is not a cheap plastic toy- it’s legit, and the sound quality is excellent. I guess the lemonade stand got enough visitors in 30 minutes, because the yelling stopped.

We shouldn’t give people responsibilities that they can’t handle. That includes debts that they can’t handle.

Which brings us to Klarna.

What is Klarna?

Klarna customers shop on the site and can set up flexible payment options to pay for products. Simply put, it’s a “buy now, pay later” business. Over 100 million people use the site, and Klarna offers over a million products.

The site provides an attractive and user-friendly buying experience.

Now let’s look at the small print- at the bottom of the home page:

“A $1,000 purchase might cost $173.53 per month over 6 months at 13.99% APR. Rate ranges from 0.00% to 35.99% APR based on creditworthiness, term length, and subject to credit approval…”

Borrowing through Klarna isn’t cheap, and it’s not a surprise that some customers can’t make the monthly payments.

Klarna’s Bad Debt Issue

As NBC News reports:

“Klarna’s customers are having a harder time paying back the installment loans they take out with the popular ‘buy now, pay later’ service.

The Swedish company’s net losses doubled in the first quarter even as its user base and revenue grew, Klarna reported Monday, weeks after pausing its plans to go public over concerns about tariffs and economic uncertainty. Klarna’s consumer credit losses swelled 17% in the first quarter from the same period a year earlier, hitting $136 million.”

Losses in the income statement are bad, no question. Bad debt losses are also a cash flow problem.

Let’s walk through an example.

Cash Flow Rollforward

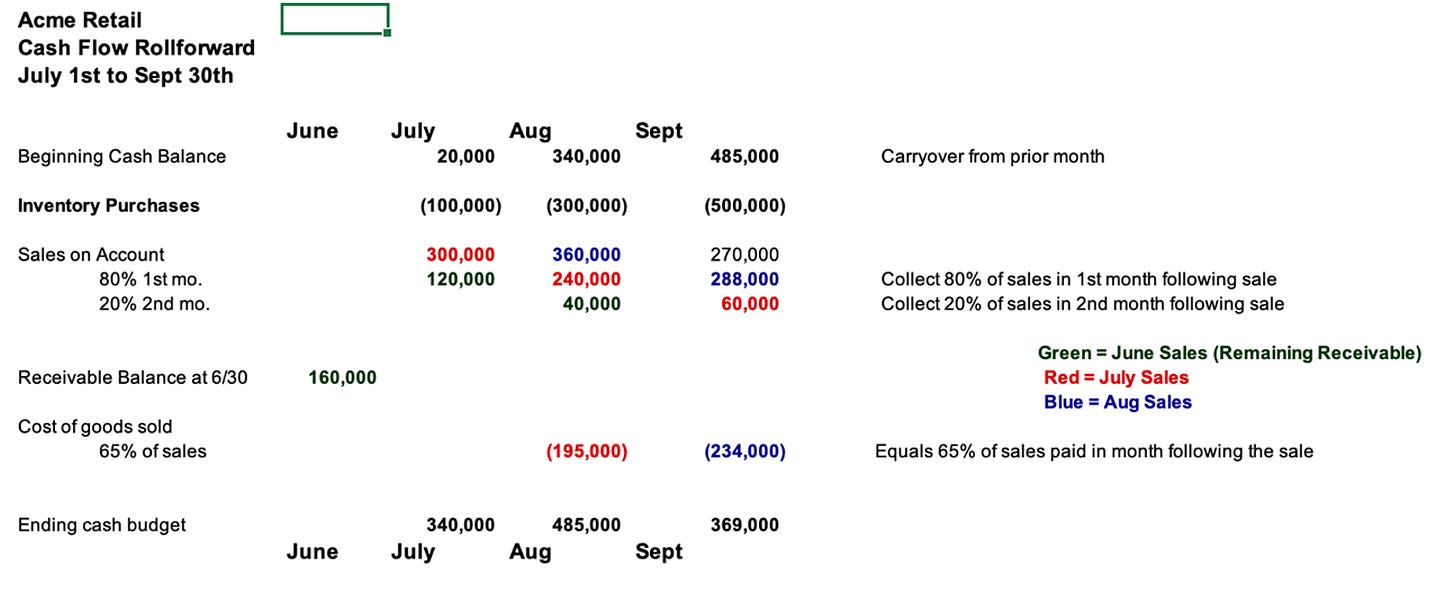

This is a cash flow rollforward. It’s a simple tool that a business owner can use to project cash flow from one month to the next:

Here are the components of the cash flow rollforward for the month of August:

Beginning cash balance: The $340,000 beginning balance is also the July ending balance. The cash balance rolls forward from July to August.

Inventory purchases: Cash outflows to purchase inventory

Sales on account: Acme Retail collects 80% of sales in the 1st month following the sale, and the other 20% two months after the sale. I use colors to illustrate how sales are paid over time.

Cost of goods sold: Cash outflows for direct material and direct labor costs (65% of sales)

Now, let’s assume that bad debts reduce the amount of cash inflows.

Bad Debt: The Financial Impact

There is the same chart, with a new set of cash inflow assumptions:

This budget assumes:

70% collected 1st month after sale

10% collected 2nd month after sale

Remaining 20% is bad debt/ not collectable

Here are the changes to August cash flow:

Sales on account/ 1st month following sale: $210,000 vs. $240,000 ($30,000 decline)

Ending cash balance: $455,000 vs. $485,000 ($30,000 decline)

If the percentage of borrowers who are not good credit risks stays the same, the problem may continue into future months. At some point, the company may need to borrow funds or raise equity to maintain operations.

A better solution? Tighten up lending policies and lend to fewer consumers who are a credit risk.

Bad debt is a profitability problem and a cash flow problem.

Food for thought.