The Landscaper's Music and Stock Volatility

He’s listening to classical music…

I was walking my dog by an elderly neighbor’s house, and I noticed rakes and a mower in the yard. An old pickup truck with more equipment was parked at the curb. As I walked by, I saw the landscaper eating lunch in the truck while he listened to… classical music.

Not what I expected.

My personal biases and expectations would have picked classic rock or country music, but I was wrong. A similar perception issue is happening with the stock market in late April 2025.

Stock market volatility: What’s really happening?

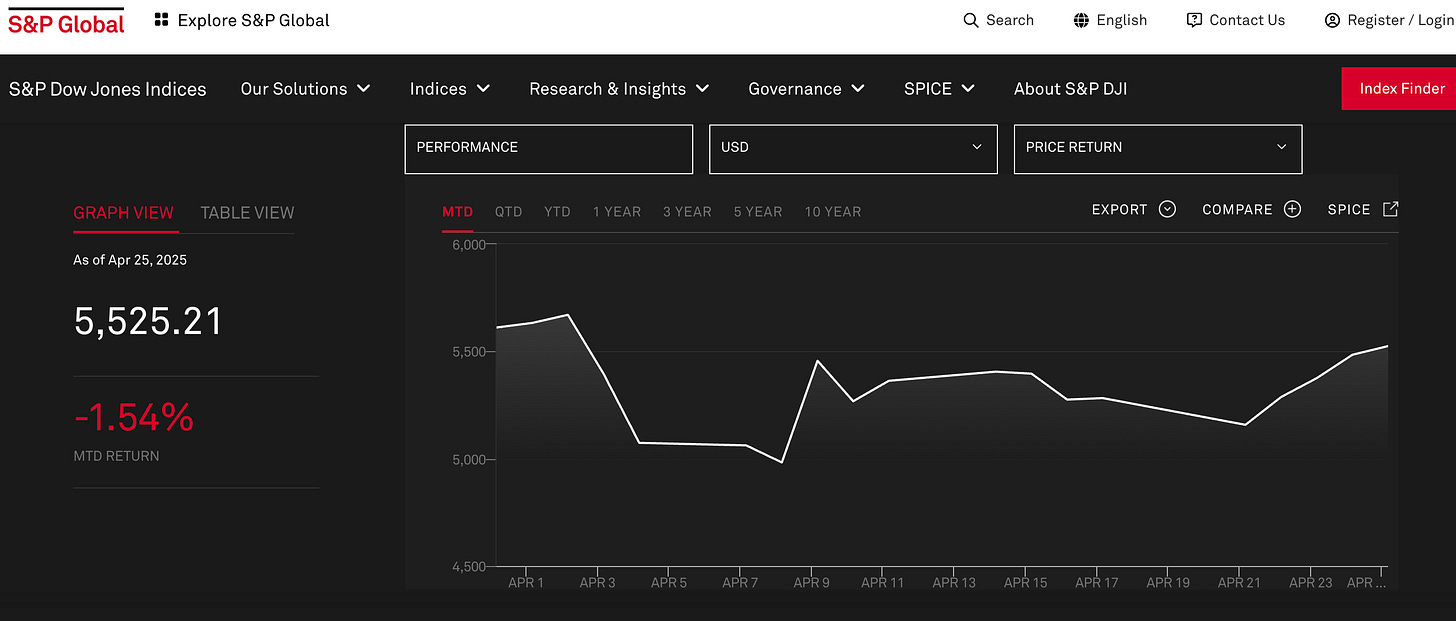

The Standard and Poor’s (S&P) 500 is an index that includes 500 of the largest publicly traded companies in the US. Think big-name firms that we all know. Here’s the performance of the index from 4/1 to 4/25/25:

Image credit: S&P Global

Trump announced his tariff plans on 4/2, and the S&P 500 was at 5,670 that day. As of Fri, 4/25, the index stands at 5,525: about a 2.6% decline during the period.

But look at the volatility along the way…

Wow.

Now, it doesn’t help that the wild market swings are all over the news and social media. It drives clicks and views, so not a surprise.

So what level of volatility is “normal” or expected, based on historical data?

Historical performance

I discuss historical stock market returns in Chapter 11 of my personal finance book:

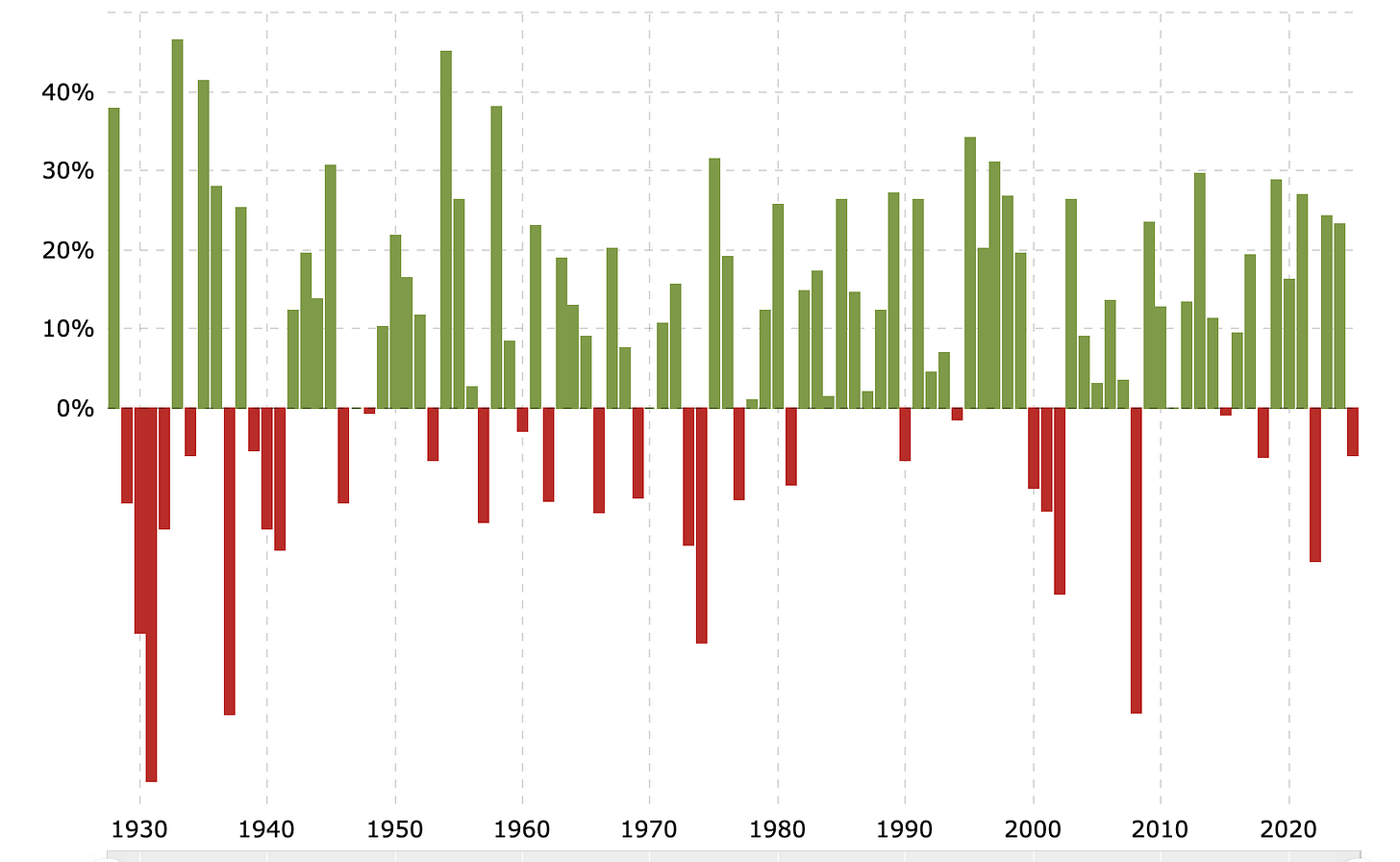

Seeking Alpha provides a great list that shows the S&P 500’s total return from 1928 to 2015. Total return assumes that capital gains (selling the stock for a gain) and dividends earned are reinvested.

As Seeking Alpha points out: “Over 88 years, the S&P 500 went up 64 years and went down 24 years…. The worst return was -43.84% in 1931. The best return was 52.56% in 1954.”

Here’s a great chart that shows annual returns from 1928 to 2025:

Image credit: Macrotrends.net

What does it all mean?

Stock market volatility has been around for nearly 100 years. If you’re a stock investor, large price swings over time just come with the territory.

Why put up with it?

The average annual return in the S&P 500 (assuming you reinvest dividends) is about 10%. It’s tough to find that long-term rate of return in other investments.

I had a preconceived notion about a landscaper’s music choice. So don’t kid yourself when it comes to stock investing: year-to-year volatility is a fact of life, but staying investment can pay off over the long term.

Discuss these topics with a financial advisor.

My 5th book: “34 Stories That Explain Personal Finance”, is available here.